Friday finance - the everything bubble?

This is the Michael Burry who correctly called the 2008 housing crash as portrayed in The Big Short.

Pretty scary huh? You’d better sell everything, hold cash and wait for the big one.

Although, here are two things to remember:

– Michael Burry runs a hedge fund. He’s famous enough to shift the market through tweets, like Elon Musk does. I’m sure he’d never take advantage of that but if he did, his fund would profit nicely.

– I’m not counting but I think Michael Burry has called about a dozen of the last two bear markets.

Don’t relax yet. Here’s a prediction of gloom from another source:

Is the stock market in a bubble? The answer is yes, absolutely, you bet it is. The interesting part is that it is not the only asset class that is in a bubble. In addition to the stock market, real estate is also in a bubble . . .

And another:

When the pin finds this bubble it’s going to take down not only our stock market, but unleash a destructive force on the global economy.

Convinced? Lucky you weren’t when these were published back in 2014 because the market has boomed since then.

Interesting charts that may inform us

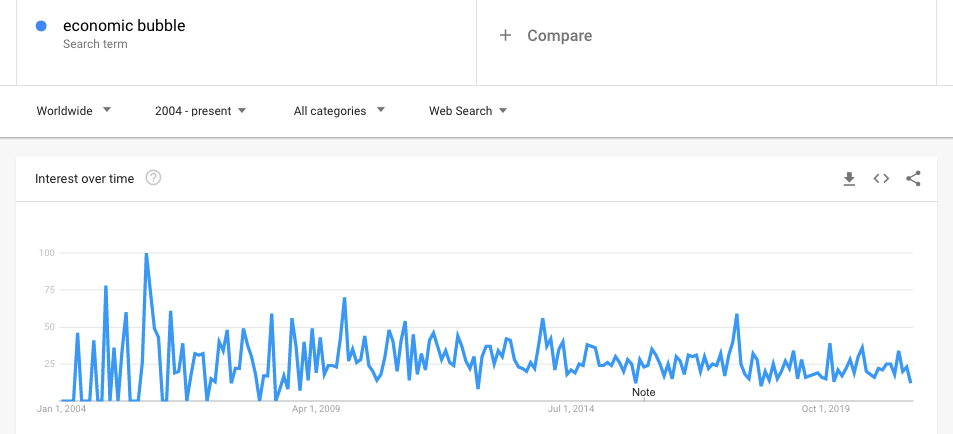

I tried looking up “everything bubble” in Google trends but unfortunately for us, there’s a Canadian-Italian musician with a name that resembles ‘bubble’ who recorded a song called ‘Everything’. This generated a lot of misspelled searches from Indonesian fans which muddied the statistical waters.

In the early days of the internet you’d randomly stumble over funny things like that all the time but it doesn’t happen much anymore.

Here are the results for ‘economic bubble’ instead:

Looks like people have been worried about bubbles since Google was cool.

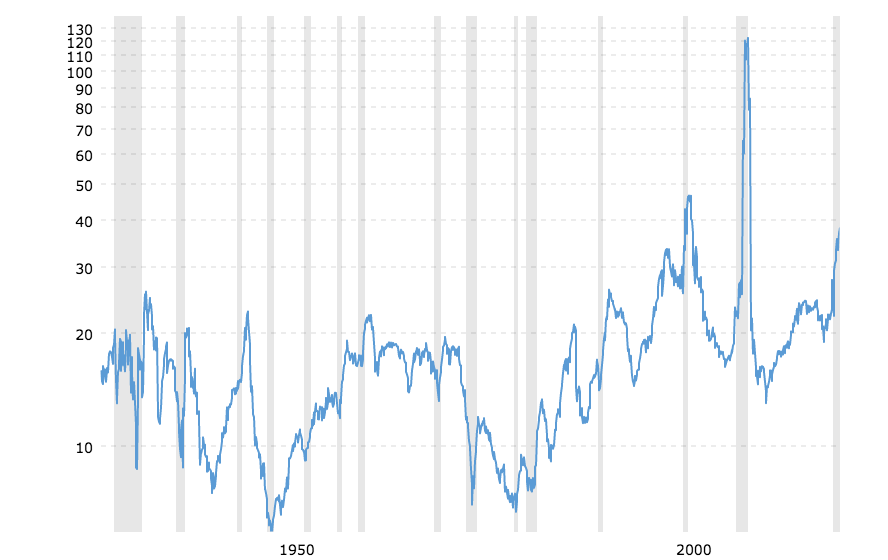

Is the market overpriced?

The Price to Earnings Ratio (P/E) is a measure of how much shares cost vs how much money companies are actually making. A high ratio suggests the market may be overheated. Let’s have a look at that, from 1929 to recently:

Note the non-linear scale on the y axis. Lol 2009. Anyway, you can see that the market is pretty expensive at the moment. Are we due for a correction, or are high P/Es normal from now on?

If so, how could that be?

There are a few reasons.

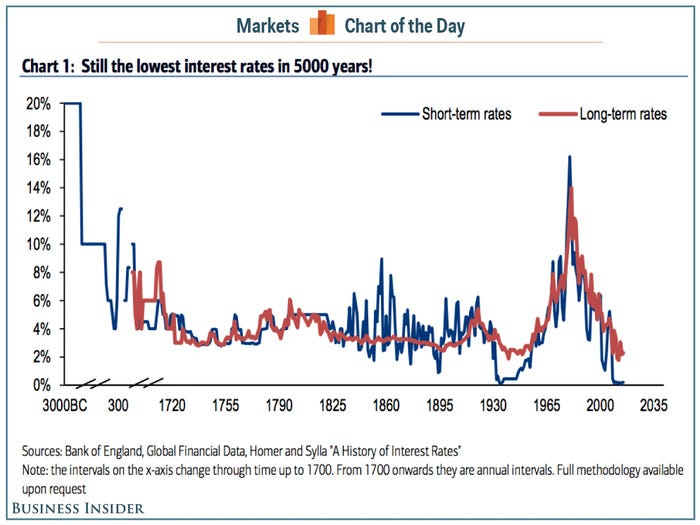

First, here’s another graph: historic interest rates:

Interest rates rose in the 1980s to counter inflation but the general trend is down, especially in recent times.

Also consider Japan, an economy further along the aging population curve than us, and its permanently near-0 rates and struggle against deflation. This suggests low rates may also lie in our future.

Perhaps the long-term trend towards low interest rates (if that’s what it is) means greater investment and persistently higher P/Es. That is, bank interest returns are so low that people invest in shares instead, pushing up share prices despite no corresponding rise in company earnings. This is speculation and I’m interested to hear what others think.

More evidence for a permanent change to the economy: increasing longevity.

With people living longer than ever before plus increased wealth, retirement savings are growing around the world. For example, here is a graph of Australia’s accumulated superannuation savings up to 2016:

The theory

People are living longer, earning more and have greater access to financial products where they can invest their savings. Perhaps this is what’s pushing up the prices of everything – stocks, bonds, real estate, crypto, everything.

Imagine three generations of Thais. Grandpa owned a small plot of land and could only sell his produce locally. He was almost completely disconnected from global markets and his main investment was in his children. Papa moved to the city and worked as a taxi driver, investing his savings in an apartment. Still no impact on the S&P 500.

Then the son completes a university degree and becomes a radiologist. Living in 2022, he has many more options to invest: local shares, international shares, real estate, crypto, whatever. And he feels the need to invest because (a) he knows he’s likely to live a long time, and (b) in his increasingly industrialised country, his children are a financial liability conceived out of love, not cheap farm hands conceived in great numbers out of economic necessity. That is, he will need to provide for himself in old age.

Now imagine hundreds of millions of people like the son, in rich countries and poor, suddenly having savings, a need to invest and access to global markets. They may push up company earnings by being newly affluent consumers, but they also push up share prices as they get in on the action. Perhaps the latter is outweighing the former.

[Edit: Having thought it over, I’ve decided that this example is misleading. The vast majority of the world’s household wealth is in America and China. No other country (alone) puts a dent the figures. Within these two giants, wealth is further concentrated in the richest 10% of households, not the middle class. Our plucky Thai radiologist doesn’t make much of a difference to the S&P, even if there are millions of others like him. The true part of the example above is that the world is much wealthier now than it used to be and rich people park a lot of this money in the S&P.]

A safer world

There are fewer wars these days, better means of hedging risk (insurance, futures, etc.), plus it is uncommon for modern cargo ships to sink in storms, fall to mutinies or be raided by buccaneers.

Borrower risk is now better quantified and managed through credit ratings. This decreased risk to lenders will naturally push interest rates down.

Perhaps the risk of a Great Depression-tier economic disaster is now lower due to central bank willingness to do whatever it takes to prop up the market, but that’s a complex topic we may consider at another time.

Putting it together

Increased global savings + increased market access – risk = higher asset prices.

If true, this means future investors will have to increase their holdings of volatile assets like stocks in order to cope with lower overall returns on investment. P/Es are stratospheric but what else can you do? Bond are also expensive and cash interest rates are in the toilet. Real estate prices are sky high.

People have to put their money somewhere, and right now a dear stock market seems a better option than non-performing, lower-risk assets.

Some of this extra money must be making its way into crypto, start-ups, R&D etc, but maybe there’s not enough room for all of it, thus pushing up stock prices to the disadvantage of those not yet in the market.

In addition, a lot of this new money is being saved in the Third World where there are fewer well-regulated opportunities to invest, especially China and India. This will push up First World markets as the money seeks a place to go.

If something is overpriced, that suggests something else must be underpriced.* But what? Physical gold and silver prices appear to be suppressed but there’s not enough room there for all this extra cash as it is an unproductive, illiquid asset unsuitable for long-term retirement savings, plus many people don’t have a place to store it.

For all these reasons, I suspect that relatively high asset prices may be permanent.

So smooth sailing ahead, then?

Ha! You wish.

No one knows the future. There might be a gut-wrenching crash tomorrow or twenty years from now.

Asset prices will continue to bump around as they always have. However, the future average P/E ratio may be higher than it was in the past, and future normal interest rates may be lower than was historically the case so long as inflation does not get out of hand. Which it might.

I’m not an economist, just a guy with a lot of opinions.

In any case, all evidence shows that trying to time the market (i.e. spot bubbles and crashes) is a fool’s game for most investors. The safest bet is to invest in low-fee index funds over a long period of time.

Don’t worry about the chatter. There is always talk of a crash. Stick to your strategy and never panic. Consider holding more shares than was traditionally recommended in order to cope with what may be a new, more expensive market for an older, richer world.

![The Poor Man's Guide to Financial Freedom: A Realistic, 10-Step Manual to Building Liberating Wealth on a Low to Medium Income by [Nikolai Vladivostok] The Poor Man's Guide to Financial Freedom: A Realistic, 10-Step Manual to Building Liberating Wealth on a Low to Medium Income by [Nikolai Vladivostok]](https://substackcdn.com/image/fetch/$s_!c990!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F187b70ae-a60f-4d5d-a3ec-9e33d9f8f4ba_333x500.jpeg)