The US threatened to put new tariffs on Canada and Mexico.

Confession: in an earlier version of this article, I claimed that the drugs/immigration angle was a fig leaf. However, that now does seem to have been the main thing. That and humiliating a couple of leaders who needed it.

I still doubt that the Mexican government can do anything to stop the drugs. They do not even have full control over their own territory.

The tariffs would also go against the newly-important concepts of friend-shoring and near-shoring. Better vital imports come from next door than from China.

Anyway, I thought the tariffs were all about that old bee in Trump’s bonnet, the trade deficit. He’s concerned because every year, the US buys about a trillion bucks worth of stuff more than it sells. Been that way since the 1970s and sometimes earlier.

In fact, it was that way even before Columbus arrived.

From about 1820-1945 the UK often ran trade deficits, especially after WWI.

The Dutch had trade deficits during the tail-end of the Dutch Golden Age. At first they ran surpluses due to trading power but the cost of wars to maintain that power got to them in the end.

Then there was Spain, back when it owned most of Latin America and its gold.

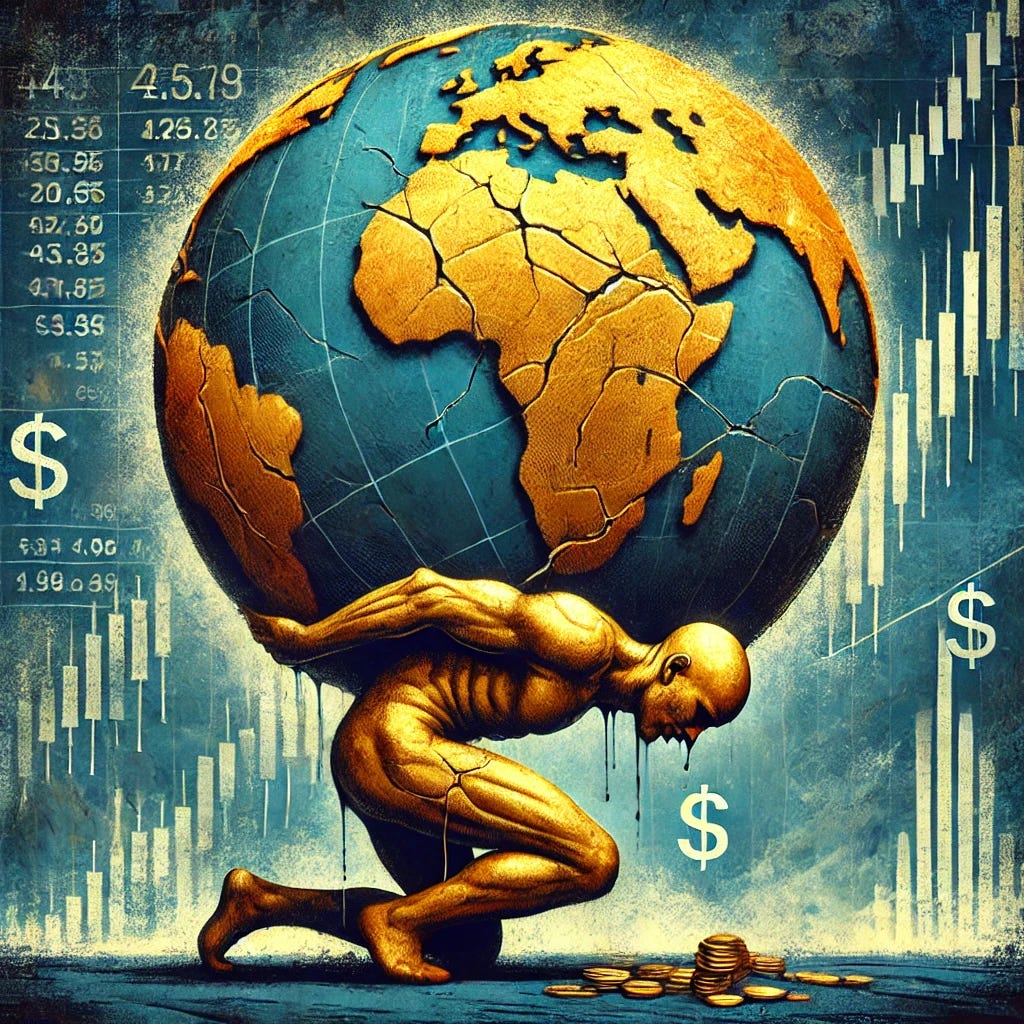

The smart readers will have spotted a pattern – success is the enemy here. Specifically, it’s the Triffin Dilemma. Global dominance leads a nation to end up holding the world’s global reserve currency, and a side effect of that is trade deficits.

At the moment, everyone needs USD to trade with each other. The US must provide those dollars, otherwise foreigners will lose confidence in the dollar and use something else to trade with. Foreigners get their hands on USD either by selling America stuff or by investing in America (buying US stocks, bonds etc.) All those imports cause the deficit.

Holding the reserve currency is in many ways a good thing. It provides ‘exorbitant privilege’ – cheaper borrowing and the ability to run these trade deficits without crisis because people will keep throwing money at you anyway, like an infinite money glitch. Plus you can get away with printing more money than normal countries can.

In addition, holding the reserve currency gives you a lot of power. It’s easier to sanction countries you don’t like because you own the world banking system and are the centre of much trade. That only lost its sting recently, and only in one case. In many other cases (as we just saw), there’s plenty of venom left.

The downsides are the trade deficits and the fact that your manufacturing sector will decline while your finance industry predominates. That strong USD makes imports too cheap to compete with.

The winners are Wall Street, consumers, and those with high-tech service sector jobs. The losers are factory workers, exporters, and low-to-medium income earners.

Further, you have to fight wars and spend heaps of money to maintain global dominance. Retreat from the world stage and your global reserve currency status will disappear.

‘Well, I don’t want this global reserve currency thing!’ some of my American readers may be thinking. What would happen if it went away?

First, much higher borrowing costs for you, businesses and the government. You might be in trouble with that national debt if those rates went up.

Next, the value of the USD would fall and become more volatile, making business planning more difficult. Imports would be more expensive. There would be more upward pressure on inflation and less scope to machine-gun print money.

You’d have reduced power globally because you’d have fewer financial sticks to beat enemies over the head with and less printed money to fund your military forces. Your allies might shift over to whoever the new big dog is (China, presumably).

Overall, you’d have to completely reorient the economy more to exports and less to imports. You might prefer the end result, but the transition would be painful.

In any case, would those suspended tariffs on Canada and Mexico have done the trick with regards to the current account deficit?

On one hand, domestic replacements for imports may become more competitive. On the other, US companies might just import them from someone else.

Also complicating things is that those two countries would impose revenge tariffs, which would hurt US exports.

Even more complicated are the supply chains. Many US exports would become even more expensive just because of their own tariffs. For example, car parts get trucked back and forth across borders in North America dozens of times before a final, ‘American’ car is produced. The manufacturer would have to pay the tax each time, raising the price of exported US cars.

Of course they would respond and change their supply chains, but that itself would be expensive.

Not enough complication for you? Here’s another one: the Canadian and Mexican currencies would likely fall – making their exports cheaper again!

If these policies were part of a raft of measures to reduce the current account deficit, sure, they might work. That is, if the US government also had a plan to reduce domestic consumption and increase domestic savings, which are the main drivers of the deficit…

If, however, it was a policy on its own, it probably wouldn’t do much except annoy the neighbours.

As of the time of writing, that appears to have been the intention.

Still, the US might need a strong domestic manufacturing capability to maintain its military dominance. How do you do that while still holding the global reserve currency, which makes the manufacturing flee, and which was the result of having military dominance in the first place?

Buggered if I know.

This might be too much outside your wheelhouse.

For example, on thing I know happened (it was in my state's backyard) is that Canada made bank nearshoring China into the U.S.

"Better vital imports come from next door than from China"

Never mind Mexico's border games.